Payment of Filing Fee (Check the appropriate box): | | | | | | ☒ | | No fee required. | ☒

| No fee required

| | ☐ | | ✶

| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 | | | | | | (1

| )

(1) | | Title of each class of securities to which transaction applies: | | | | | (2

| )

(2) | | Aggregate number of securities to which transaction applies: | | | | | (3

| )

(3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | | | | | (4

| )

(4) | | Proposed maximum aggregate value of transaction: | | | | | (5

| )

(5) | | Total fee paid: | | | | | | | ✶

☐ | | Fee paid previously with preliminary materials. | | | ✶

☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | | | | | | (1

| )

(1) | | Amount Previously Paid: | | | | | (2

| )

(2) | | Form, Schedule or Registration Statement No.: | | | | | (3

| )

(3) | | Filing Party: | | | | | (4

| )

(4) | | Date Filed: | | | |

SUN HYDRAULICS CORPORATION NOTICE OF ANNUAL MEETING OF SHAREHOLDERS Thursday, May 31, 2018 June 13, 2019 Notice hereby is given that the Annual Meeting of Shareholders of Sun Hydraulics Corporation, a Florida corporation, will be held on Thursday, May 31, 2018,June 13, 2019, at 9:10:00 a.m., CentralEastern Daylight Time, at the River Spirit Casino Resort, 8330 Riverside Pkwy, Tulsa, OK 74137,The Benjamin Hotel 125 E 50th Street, New York, NY 10022, for the following purposes: | 1. | 1.

| To elect twothree Directors to serve until the Annual Meeting in 2022, and to elect one Director to serve until the Annual Meeting in 2021, and until their successors are elected and qualified or until their earlier resignation, removal from office or death; | |

| 2. | To approve an amendment to the Corporation’s articles of incorporation to change the name of the Corporation to Helios Technologies, Inc.; | |

| 3. | 2.To approve an amendment to the Corporation’s articles of incorporation to increase the number of authorized shares of common stock, par value $0.001 per share, to 100,000,000 shares;

| |

| 4. | To approve the Helios Technologies 2019 Equity Incentive Plan; | |

| 5. | To ratify the appointment of Grant Thornton LLP as the Company’s independent registered public accounting firm for the year 2018;2019; | |

| 6. | 3.

| To conduct an advisory vote on executive compensation; and | |

| 7. | 4.

| To transact such other business as properly may come before the Meeting or any adjournment thereof. | |

Shareholders of record at the close of business on March 23, 2018,April 4, 2019, are entitled to receive notice of and to vote at the Meeting and any adjournment thereof. We sent a Notice of Internet Availability of Proxy Materials on or about April 18, 2018,26, 2019, and provided access to our proxy materials over the Internet, beginning April 18, 2018,26, 2019, for the holders of record and beneficial owners of our common stock as of the close of business on the record date. If you received a Notice of Internet Availability by mail, you will not receive a printed copy of the proxy materials in the mail. Instead, the Notice of Internet Availability instructs you on how to access and review this proxy statement and our annual report and authorize a proxy online to vote your shares. If you received a Notice of Internet Availability by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials included in the Notice of Internet Availability. All shareholders are cordially invited to attend the Meeting. Whether or not you expect to attend, to assure the presence of a quorum at the Meeting, please authorize your proxy by Internet or, if you received a paper copy of the materials by mail, please mark, sign, date and return your proxy card, so that your shares will be represented at the Meeting. You may revoke your Proxy and vote in person at the Meeting if you desire. If your shares are held in street name by a brokerage, your broker will supply the Notice of Internet Availability instructions on how to access and review this proxy statement and our annual report and authorize a proxy online to vote your shares. If you receive paper copies of the materials from your broker by mail, please mark, sign, date and return your proxy card to the brokerage. It is important that you return your proxy to the brokerage as quickly as possible so that the brokerage may vote your shares. You may not vote your shares in person at the Meeting unless you obtain a power of attorney or legal proxy from your broker authorizing you to vote the shares, and you present this power of attorney or proxy at the Meeting. | By Order of the Board of Directors,

|

| GREGORY C. YADLEY | Secretary |

Sarasota, Florida April 18, 201826, 2019 IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDERS MEETING TO BE HELD ON MAY 31, 2018JUNE 13, 2019 This Proxy Statement and our 20172018 Annual Report to Shareholders are available at: https://materials.proxyvote.com/866942andhttp:https://www.sunhydraulics.com/annualreport/ir.heliostechnologies.com.

TABLE OF CONTENTS

This page intentionally left blank.

| | |  | | 2019 Proxy Statement| i |

SUN HYDRAULICS CORPORATION 1500 West University Parkway Sarasota, Florida 34243 PROXY STATEMENT This proxy overview is a summary of information that you will find throughout this proxy statement. As this is only an overview, we encourage you to read the entire proxy statement, which was first distributed to our stockholders onor about April 26, 2019. PROXY STATEMENT2019 ANNUAL MEETING OF SHAREHOLDERS

| | | | | | Time and Date: | | Thursday, June 13, 2019, at 10:00 a.m. (Eastern Daylight Time) | | Place: | | The Benjamin Hotel 125 E 50th St., New York, NY 10022 | | Record Date: | | April 4, 2019 | | Voting: | | Shareholders as of the record date may vote on or before 11:59 p.m. Eastern Daylight Time on June 12, 2019 for shares held directly and by 11:59 p.m. Eastern Daylight Time on June 10, 2019 for shares held in a Plan through one of the following options: |

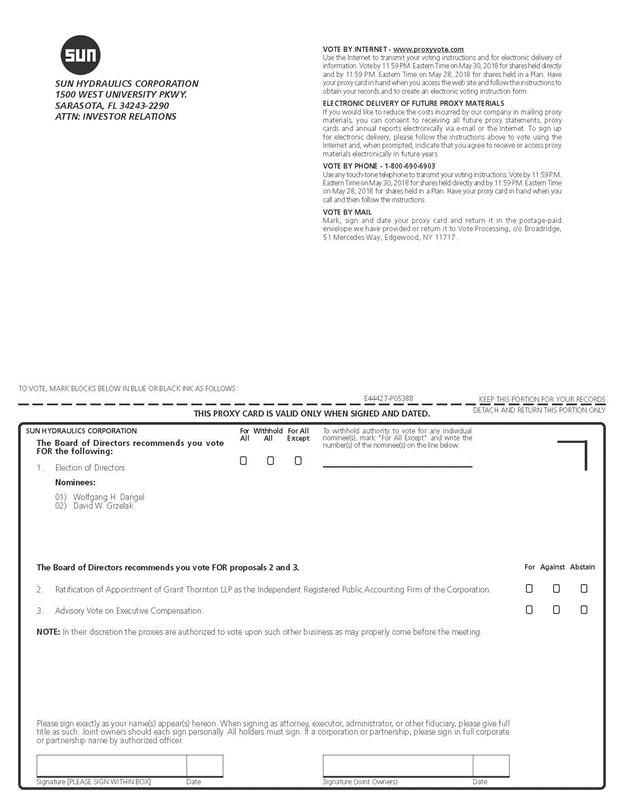

This Proxy Statement is furnished by the Board of Directors of Sun Hydraulics Corporation (the “Company”) in connection with the solicitation of proxies to be voted at the Company’s 2018 Annual Meeting of Shareholders, which will be held on Thursday, May 31, 2018, at 9:00 a.m., Central Daylight Time, at the River Spirit Casino Resort, 8330 Riverside Pkwy, Tulsa, OK 74137 (the “Meeting”).

| | | | | | |

By completing, signing and dating the voting instructions in the envelope provided | |

By the internet at www.proxyvote.com | |

By telephone at 1-800-690-6903 | |

In person by completing, signing and dating a ballot at the annual meeting |

Any proxy delivered pursuant to this solicitation may be revoked, at the option of the person executing the proxy, at any time before it is exercised by delivering a signed revocation to the Company, by submitting a later-dated proxy, or by attending the Meeting in person and casting a ballot. If proxies are signed and returned without voting instructions, the shares represented by the proxies will be voted as recommended by the Board of Directors. The cost of soliciting proxies will be borne by the Company. In addition to the use of the mail, proxies may be solicited personally or by telephone by regular employees of the Company. The Company does not expect to pay any compensation for the solicitation of proxies, but may reimburse brokers and other persons holding stock in their names, or in the names of nominees, for their expense in sending proxy materials to their principals and obtaining their proxies. The approximate date on which this Proxy Statement and enclosed form of proxy first has been mailed or made available over the Internet to shareholders as of April 18, 2018.26, 2019. The close of business on March 23, 2018,April 4, 2019, has been designated as the record date for the determination of shareholders entitled to receive notice of and to vote at the Meeting. As of March 23, 2018, 31,587,244April 4, 2019, 32,011,375 shares of the Company’s Common Stock, par value $.001 per share, were issued and outstanding. Each shareholder will be entitled to one vote for each share of Common Stock registered in his or her name on the books of the Company on the close of business on March 23, 2018,April 4, 2019, on all matters that come before the Meeting. Abstentions will be counted as shares that are present and entitled to vote for purposes of determining whether a quorum is present. Shares held by nominees for beneficial owners will also be counted for purposes of determining whether a quorum is present if the nominee has the discretion to vote on at least one of the matters presented, even though the nominee may not exercise discretionary voting power with respect to other matters and even though voting instructions have not been received from the beneficial owner (a “brokernon-vote”). Abstentions and brokernon-votes are not counted in determining whether a proposal has been approved. | | |  | | 2019 Proxy Statement| 1 |

PROPOSAL 1 — ELECTION OF DIRECTORS The Board of Directors of the Company currently consists of eightseven members. The Board is divided into three classes of Directors serving staggered three-year terms. Directors hold their positions until the annual meeting of shareholders in the year in which their terms expire, and until their respective successors are elected and qualified or until their earlier resignation, removal from office or death. The term of office of three of the Company’s current eightseven Directors, Allen J. Carlson, Wolfgang H. Dangel, and David W. Grzelak, Marc Bertoneche, Douglas M. Britt, Philippe Lemaitre, will expire at the Meeting. The Governance and Nominating Committee of the Board of Directors has selected Messrs. DangelBertoneche, Britt and GrzelakLemaitre as nominees to stand for reelection to the Board at the Meeting, to serve until the Company’s annual meeting in 2022. The Committee also has determined to nominate Kennon H. Guglielmo for election to the Board at the Meeting, to serve until the Company’s annual meeting in 2021. In making its nominations of Messrs. DangelBertoneche, Britt, Guglielmo, and Grzelak,Lemaitre, the Governance and Nominating Committee reviewed the backgrounds of the twofour individuals and believes that each of them (as well as each other continuing Director whose term does not expire at the Meeting) has valuable individual skills and experiences that, taken together, provide the Company with the diversity and depth of knowledge, judgment and vision necessary to provide effective oversight. Biographical information for each of the nominees is set forth below under “Directors and Executive Officers.” Shareholders may vote for up to twothree nominees for the class of Directors who will serve until the Company’s annual meeting in 2022 and for one nominee, Dr. Guglielmo, for the class of Directors who will serve until the Company’s annual meeting in 2021. If a quorum is present at the meeting, Directors will be elected by a plurality of the votes cast. Shareholders may not vote cumulatively in the election of Directors. In the event any of the nominees should be unable to serve, which is not anticipated, the proxy committee, which consists of Philippe Lemaitre and Christine L. Koski and Alexander Schuetz, will vote for such other person or persons for the office of Director as the Board of Directors may recommend. The Board of Directors recommends that you vote “FOR” Messrs. Dangel and Grzelak to serve until the Company’s annual meeting in 2021, or until their successors shall be duly elected and qualified or until their earlier resignation, removal from office or death. Executed proxies in the accompanying form will be voted at the Meeting in favor of the election as directors of the nominees named above, unless authority to do so is withheld.

| | | | |

| | | | The Board of Directors recommends that you vote“FOR” Messrs. Bertoneche, Britt and Lemaitre to serve until the Company’s annual meeting in 2022, and“FOR” Dr. Guglielmo to serve until the annual meeting in 2021, or until their successors shall be duly elected and qualified or until their earlier resignation, removal from office or death. Executed proxies in the accompanying form will be voted at the Meeting in favor of the election as directors of the nominees named above, unless authority to do so is withheld. |

| | | 2 |2019 Proxy Statement | |  |

GOVERNANCE OF THE COMPANY Directors and Executive Officers The following table sets forth the names and ages of the Company’s Directors, nominees for Director, and executive officers and the positions they hold with the Company. Executive officers serve at the pleasure of the Board of Directors.

| | | | | | | | | | | | | NameName/Age/Independence

| | Age Director

Since | | | | Position

Committee Membership (C: Chair) | | Biographies | | Audit | | Comp. | | Gov. and

Nominating | | | | | | | |  | | Wolfgang H. Dangel, 55 President, CEO and Director | | June

542009

| | Wolfgang Dangel became President and Chief Executive Officer of the Company on April 1, 2016. From January 2014 to March 2016, he was a consultant to the Schaeffler Holding Company. From September 2011 to December 2013, he served as President of Schaeffler Automotive Global and a member of the Executive Board of the Schaeffler Group and, from January 2007 to September 2011, as President of Schaeffler Group Asia/Pacific and a member of the Extended Management Board of Schaeffler Group (Global). Mr. Dangel previously served as President, CEO and CFO of Bosch Rexroth North America, from January 2001 to December 2006. Prior to that, he was affiliated with other Mannesmann and Rexroth companies, including as Managing Director (term expiringand Chairman of the Management Board of Mannesmann Rexroth (China) Ltd. from June 1996 to December 2000. Mr. Dangel previously served as a member of the board of directors of the National Fluid Power Association.He holds a Master’s Degree in 2018)Economics from the University of Applied Sciences in Rosenheim, Germany. Mr. Dangel has served as a Director of the Company since June 2009. With more extensive experience working in the fluid power industry and in Asia, Mr. Dangel brings a wealth of knowledge regarding the customers and markets in which the Company’s products are sold. | | | | | | | | | | | | | |  | | Marc Bertoneche, Nominee72 Independent Director | | August

2001 | | Marc Bertoneche is an Emeritus Professor in Business Administration at the University of Bordeaux in France, and was on the Faculty of INSEAD, the European Institute of Business Administration in Fontainebleau, France, for more than 20 years. He was a Visiting Professor of Finance at the Harvard Business School. He is an Associate Fellow at the University of Oxford and a Distinguished Visiting Professor at HEC Paris. Dr. Bertoneche is a graduate of University of Paris and earned his MBA and PhD from Northwestern University. He has served as a Director (term expiringof the Company since August 2001. As an academic and a consultant to universities and businesses throughout the world, Dr. Bertoneche is exposed to diverse business leaders and brings a global perspective and depth of experience in 2021)the finance area. | | ● | | ● | | | | | | | | | |  | | Douglas M. Britt, 54 Independent Director | | December

2016 | | Doug Britt has been a Director of the Company since December 2016. Mr. Britt is President of Flex Ltd. (NASDAQ: FLEX), a leadingsketch-to-scale™ solutions company that provides innovative design, engineering, manufacturing, real-time supply chain insight, and logistics services to companies of all sizes in various industries andend-markets. From May 2009 to November 2012, Mr. Britt served as Corporate Vice President and Managing Director of Americas for Future Electronics, and from November 2007 to May 2009, he was Senior Vice President of Worldwide Sales, Marketing, and Operations for Silicon Graphics. From January 2000 to October 2007, Mr. Britt held positions of increasing responsibility at Solectron Corporation, culminating his career there as Executive Vice President, and was responsible for Solectron’s customer business segments including sales, marketing and account and program management functions. Mr. Britt earned a bachelor’s degree in business administration from California State University, Chico, and attended executive education programs throughout Europe, including at the University of London. As an executive at multinational companies, Mr. Britt has extensive global mergers and acquisition experience, global manufacturing and supply chain expertise and a deep understanding of customer relationships and leading a global business. | | ● | | C | | |

| | |  | | 2019 Proxy Statement| 3 |

| | Governance of the Company |

| | | | | | | | | | | | | Name/Age/Independence | | Director Since | | | | Committee Membership (C: Chair) | | Biographies | | Audit | | Comp. | | Gov. and

Nominating | | | | | | | |  | | David W. Grzelak, 69 Independent Director | | June

2015 | | Mr. Grzelak has served on the board of directors of Alamo Group Inc. (NYSE: ALG) since August 2006. He also serves on Alamo’s Compensation Committee, Audit Committee and Nominating/Corporate Governance Committee. Dave Grzelak has been a director of the Company since June 2015. He served as Chairman and Chief Executive Officer of Komatsu America Corporation from April 2002 until his retirement as Chief Executive Officer in April 2012 and as Chairman in July 2013. He then served as a consultant to Komatsu Ltd., Tokyo, Japan, until August 2015. With more than four decades of experience working in the industrial manufacturing sector and extensive experience in Asia, Mr. Grzelak brings a wealth of knowledge regarding the customers and markets in which the Company’s products are sold. Mr. Grzelak brings to the Board valuable insights on distribution, marketing and sales of the Company’s products as well as operational and financial expertise. | | C | | | | ● | | | | | | | |  | | Christine L. Koski, 61 Independent Director | | May

2000 | | Christine Koski joined the executive team of nMetric, LLC as head of marketing in July 2006 and has served as its President and Chief Executive Officer since January 2011. Ms. Koski is also the Chief Executive Officer of ProBiora Health, LLC. Ms. Koski purchased the probiotic business unit from Oragenics and took over as its CEO. Simultaneous to the acquisition, Ms. Koski resigned from the board of directors of Oragenics, Inc. (OGEN). Prior to joining nMetric, Ms. Koski founded Koski Consulting Group, Inc. in June 2001 to work with start-up companies in the area of business strategy and marketing. From 1980 through 2000, Ms. Koski held various positions in sales, product management, purchasing, sales management, and international marketing management with Celanese A.G. or its former affiliates, including Celanese Ltd., Hoechst AG and Hoechst Celanese Chemical Group Ltd. Ms. Koski is also a member of the National Association of Corporate Directors, Dallas Chapter, and is an alumnus of Harvard’s Corporate Board Effectiveness Program led by Professor Jay Lorsch. Ms. Koski has served as a Director of the Company since May 2000. Her international sales and marketing background contribute to the Board’s overall level of experience in these areas. Ms. Koski graduated from St. Lawrence University with a BS degree in chemistry and received an Executive MBA degree from Southern Methodist University. | | | | ● | | ● | | | | | | | |  | | Philippe Lemaitre, 69 Independent Director and Chairman of the Board | | June

2007 | | Philippe Lemaitre retired in November 2006 as Chairman, President and Chief Executive Officer of Woodhead Industries, Inc., a publicly-held automation and electrical products manufacturer, upon its sale to Molex. Before joining Woodhead in 1999, Mr. Lemaitre was Corporate Vice President and Chief Technology Officer of AMP, Inc. and was also in charge of AMP Computer and Telecom Business Group Worldwide. Prior to joining AMP, Mr. Lemaitre was an Executive Vice President of TRW, Inc. and also General Manager of TRW Automotive Electronics Group Worldwide. He previously held various management and research engineering positions with TRW, Inc., International Technegroup, Inc., General Electric Company and Engineering Systems International. Mr. Lemaitre also served as Chairman of the Board of Directors of Multi-Fineline Electronix, Inc. from March 2011 until the sale of the company in July 2016. Mr. Lemaitre holds a Master of Civil Engineering degree from | | | | | | |

| | | 4 |2019 Proxy Statement | |  |

| | Governance of the Company |

| | | | | | | | | | | | | Name/Age/Independence | | Director Since | | | | Committee Membership (C: Chair) | | Biographies | | Audit | | Comp. | | Gov. and

Nominating | | | | | | | Ecole Spéciale des Travaux Publics, Paris, France, and a Master of Science degree from the University of California at Berkeley, California. Mr. Lemaitre has served as a Director of the Company since June 2007, and as Chairman of the Board since June 2013. Mr. Lemaitre’s more than 35 years of experience in the development of technology and with technology-driven businesses, his track record of successfully managing global business functions including sales, engineering, research and manufacturing operations, and his role as Chairman of another public company provide a wealth of experience in key areas of the Company’s business and governance. | | | | | | | | | | | | | |  | | Alexander Schuetz, 52 Independent Director | | June

2014 | | Alexander Schuetz serves as CEO of Knauf Engineering GmbH, an engineering company in the gypsum based construction materials industry. Prior to joining Knauf in February 2009, Dr. Schuetz held various management positions for more than 10 years in Finance, Business Development, Mergers & Acquisitions, Project Management and General Management in the fluid power industry at Mannesmann and Bosch Rexroth, including as CEO of Rexroth Mexico and Central America from August 2000 to August 2007. From 1998 to 2000, he was based in Beijing, China and was responsible for the Finance, Tax and Legal division at Mannesmann (China) Ltd., the holding company for a number of affiliated companies of the Mannesmann Group, including Rexroth, Demag, Sachs and VDO. Dr. Schuetz holds a Ph.D. in international commercial law from the University of Muenster, Germany. In 2003, Dr. Schuetz completed the Robert Bosch North America International General Management Program at Carnegie Mellon University. Dr. Schuetz has served as a Director of the Company since June 2014. With more than ten years working in the fluid power industry and extensive experience in major growth regions of the world, including Asia and Latin America, Dr. Schuetz brings global insights into markets and customers to the Company. | | ● | | | | C |

| | |  | | 2019 Proxy Statement| 5 |

| | Governance of the Company |

| | | | | | | Name/Age | | | | Executive

Officer Since | | Biographies | | | | |  | | Wolfgang H. Dangel, 55 President, CEO and Director | | June

2009 | | Wolfgang Dangel became President and Chief Executive Officer of the Company on April 1, 2016. From January 2014 to March 2016, he was a consultant to the Schaeffler Holding Company. From September 2011 to December 2013, he served as President of Schaeffler Automotive Global and a member of the Executive Board of the Schaeffler Group and, from January 2007 to September 2011, as President of Schaeffler Group Asia/Pacific and a member of the Extended Management Board of Schaeffler Group (Global). Mr. Dangel previously served as President, CEO and CFO of Bosch Rexroth North America, from January 2001 to December 2006. Prior to that, he was affiliated with other Mannesmann and Rexroth companies, including as Managing Director and Chairman of the Management Board of Mannesmann Rexroth (China) Ltd. from June 1996 to December 2000. Mr. Dangel previously served as a member of the board of directors of the National Fluid Power Association.He holds a Master’s Degree in Economics from the University of Applied Sciences in Rosenheim, Germany. Mr. Dangel has served as a Director of the Company since June 2009. With more extensive experience working in the fluid power industry and in Asia, Mr. Dangel brings a wealth of knowledge regarding the customers and markets in which the Company’s products are sold. | | | | |  | | Tricia L. Fulton, 52 | 51

| Chief Financial Officer | | March

2006 | | Tricia Fulton joined the Company in March 1997 and held positions of increasing responsibility, including Corporate Controller, prior to being named Chief Financial Officer on March 4, 2006. From July 1995 to March 1997, Ms. Fulton served as the Director of Accounting for Plymouth Harbor. From November 1991 to July 1995, she served in various financial capacities for Loral Data Systems. From September 1989 to September 1991, Ms. Fulton was an auditor with Deloitte & Touche. Ms. Fulton is a graduate of Hillsdale College and the General Management Program at the Harvard Business School. She serves as a member of the board of directors of the National Fluid Power Association. | | | | |  | | Gary A. Gotting, 56 Global Lead, CVT Product Development and Marketing | | November

552013

| | Gary Gotting joined the Company in November 2013 and prior to being named Global Lead, CVT Product Development and Marketing, he had regional leadership responsibilities in sales and marketing of cartridge valve technology (“CVT”) in the Americas. From January 2008 to November 2013, he was VP of Sales and Marketing at High Country Tek, Inc., the Company’s first venture into electronics. From 2007-2008, Mr. Gotting was senior product manager for the advanced technology and systems group of Eaton Corporation in Eden Prairie, MN. He was affiliated with Denison Hydraulics from 1993-2007, first managing electronics and systems development for Denison Hydraulics International in England, and then relocating to the company’s U.S. corporate headquarters in Marysville Ohio, as global electronics and controls manager in 2000. When Denison Hydraulics Inc. was purchased by Parker Hannifin Corporation in 2003, he moved to a role in Parker’s global mobile group, where he remained until 2007, when he joined Eaton. Mr. Gotting is a graduate of Brighton College of Technology in England and holds higher education certificates in electronics and communications engineering. | | | | |  | | Kennon H. Guglielmo, 52 | 51Nominee for Director

| (term expiring in 2021) (Former Global Co-Lead Electronic Controls) | | December

2016 | | Kennon Guglielmo served asCo-General Manager of Enovation Controls, LLC (“Enovation”) from the time it was acquired by the Company on December 5, 2016, until April 5, 2019. Heco-founded Enovation, which operates as a separate, standalone subsidiary of the Company, in September 2009, first serving as its Chief Technology Officer and subsequently as itsCo-Chief Executive Officer, along withco-founder Frank Murphy, III. Dr. Guglielmo currently serves as CEO of Genisys Controls, LLC, a segment of Enovation that was carved out prior to Enovation’s acquisition by the Company. Dr. Guglielmo has been an independent director of Rush Enterprises, Inc. (NASDAQ:RUSHA) (NASDAQ:RUSHB) since January 2015. He holds a B.S. in Mechanical Engineering from Texas A&M University and an M.S. and Ph.D. in Mechanical Engineering from The Georgia Institute of Technology. Along with his executive and entrepreneurial background and skills, Dr. Guglielmo will bring a wealth of experience in the electronics area and product development to the Board. | | | | |  | | Jinger J. McPeak, 43 | 42

| 2018: Global Co-Lead Electronic Controls; 2019: President, Electronic Controls | | December

2016 | | Jinger McPeak served asCo-General Manager of Enovation Controls, LLC, which was acquired by the Company on December 5, 2016, and operates as a separate, standalone subsidiary. On April 5, 2019, Ms. McPeak assumed full leadership responsibilities for Enovation Controls. She joined the predecessor company to Enovation in September 2004. In the 15 years with the company, Ms. McPeak has served in roles spanning from Market Management to Engineering, including leadership of the company-wide Display Solutions Team. Prior to the acquisition Ms. McPeak was the Vice President of Vehicle Technologies. She has over 20 years of experience and has been responsible for all aspects of managing the critical success factors of Enovation’s display and controller technology serving the recreational, marine andoff-highway segments. Prior to joining the company, Ms. McPeak was employed at Mercury Marine, a Brunswick division, from May 1997 to September 2004 where she held several leadership positions, including Quality Engineer, Sales Administration Manager, Lean Six Sigma Program Officer and National Sales Manager. Her background includes a strong focus on market development and product portfolio strategy, including product quality & performance, program planning, timing and management, executive communication of strategic direction and tactical planning at all corporate levels. Ms. McPeak completed her education in 2001 by adding an MBA from Oklahoma State University to her Bachelor of Arts degree in Statistics. She currently serves on the BoatPAC board of the National Marine Manufacturers Association. |

| | | 6 |2019 Proxy Statement | |  |

| | Governance of the Company |

| | | | | | | Name/Age | | | | Executive

Officer Since | | Biographies | | | | |  | | Melanie M. Nealis, 44 Chief Legal and Compliance Officer and Assistant Secretary | | July 2018 | | Melanie Nealis joined the Company in July 2018 and brings over 20 years of experience in legal and human resources to the Company. She currently serves as the Chief Legal and Compliance Officer & Assistant Secretary for the organization and its subsidiaries. She is responsible for managing the legal and compliance activities of the enterprise on a global basis. Prior to joining the Company, Ms. Nealis was the Deputy General Counsel of Roper Technologies, Inc. (NYSE:ROP) from 2012 to 2018 and senior corporate counsel to Nordson Corporation (NASDAQ:NDSN) from 2005 to 2012. In both of her previousin-house roles, Ms. Nealis was responsible for managing legal services and compliance programs globally. Her responsibilities included: mergers & acquisitions, litigation management, developing and administering compliance programs, labor & employment, commercial contracts, global trade advice and compliance, and other regulatory and compliance activities. Ms. Nealis graduated with a BSBA, summa cum laude, from Xavier University and has a Juris Doctorate degree from the Ohio State University Moritz College of Law, where she graduated with honors in law. Prior to herin-house roles, Ms. Nealis was in private practice in Cleveland, Ohio, beginning her career at the national law firm of Baker & Hostetler LLP. Before becoming an attorney, Ms. Nealis worked as a human resource professional at the Timken Company in Canton, Ohio. | | | | |  | | Craig Roser, 61 Global Lead, CVT Sales and Business Development | | August

2009 | | Craig Roser | 60

| joined the Company in August 2009 and had regional leadership responsibilities in marketing, sales and business development in the Americas before becoming Global Lead, CVT Sales and Business Development | Marc Bertoneche

| 71

| Director (term expiring Lead in 2019),August of 2016. Mr. Roser graduated from the University of South Florida in 1979 with a mechanical engineering degree and worked in the textile and tire making industries until 1983, when he joined Gulf Controls Company LLC, a Sun Hydraulics Distributor. Mr. Roser last served as Vice President Engineering of Gulf Controls before being selected in 2001 as President of Hydro Air LLC, another fluid power component and systems distributor who then had the same owner as Gulf Controls. Mr. Roser is a licensed professional engineer and participates in committee activities of the National Fluid Power Association and the American Society of Mechanical Engineers. Mr. Roser also earned a law degree from The Florida State College of Law and is a member of the Audit and Compensation Committees

| Douglas M. Britt

| 53

| Director (term expiring in 2019) and a member of the Audit and Compensation Committees

| Allen J. Carlson

| 67

| Director (term expiring in 2018)

| David W. Grzelak

| 68

| Director (term expiring in 2018), Nominee for Director (term expiring in 2021) and a member of the Audit and Governance and Nominating Committees

| Christine L. Koski

| 60

| Director (term expiring in 2020). and a member of the Compensation and Governance and Nominating Committees

| Philippe Lemaitre

| 68

| Chairman of the Board, Director (term expiring in 2019)

| Alexander Schuetz

| 51

| Director (term expiring in 2020), and a member of the Audit and Governance and Nominating CommitteesThe Florida Bar.

|

Wolfgang Dangel became President and Chief Executive Officer of the Company on April 1, 2016. From January 2014 to March 2016, he was a consultant to the Schaeffler Holding Company. From September 2011 to December 2013, he served as President of Schaeffler Automotive Global and a member of the Executive Board of the Schaeffler Group and, from January 2007 to September 2011, as President of Schaeffler Group Asia/Pacific and a member of the Extended Management Board of Schaeffler Group (Global). Mr. Dangel previously served as President, CEO and CFO of Bosch Rexroth North America, from January 2001 to December 2006. Prior to that, he was affiliated with other Mannesmann and Rexroth companies, including as Managing Director and Chairman of the Management Board of Mannesmann Rexroth (China) Ltd. from June 1996 to December 2000. Mr. Dangel previously served as a member of the board of directors of the National Fluid Power Association. He holds a Masters Degree in Economics from the University of Applied Sciences in Rosenheim, Germany. Mr. Dangel has served as a Director of the Company since June 2009. With more than a decade of direct experience working in the fluid power industry and extensive experience in Asia, Mr. Dangel brings a wealth of knowledge regarding the customers and markets in which the Company’s products are sold.

Tricia Fulton joined the Company in March 1997 and held positions of increasing responsibility, including Corporate Controller, prior to being named Chief Financial Officer on March 4, 2006. From July 1995 to March 1997, Ms. Fulton served as the Director of Accounting for Plymouth Harbor. From November 1991 to July 1995, she served in various financial capacities for Loral Data Systems. From September 1989 to September 1991, Ms. Fulton was an auditor with Deloitte & Touche. Ms. Fulton is a graduate of Hillsdale College and the General

Management Program at the Harvard Business School. She serves as a member of the executive committee and board of directors of the National Fluid Power Association.

Gary Gotting joined the Company in November 2013 and prior to being named Global Lead, CVT Product Development and Marketing, he had regional leadership responsibilities in sales and marketing of cartridge valve technology (“CVT”) in the Americas. From January 2008 to November 2013, he was VP of Sales and Marketing at High Country Tek, Inc., the Company’s first venture into electronics. From 2007-2008, Mr. Gotting was senior product manager for the advanced technology and systems group of Eaton Corporation in Eden Prairie, MN. He was affiliated with Denison Hydraulics from 1993-2007, first managing electronics and systems development for Denison Hydraulics International in England, and then relocating to the company’s U.S. corporate headquarters in Marysville Ohio, as global electronics and controls manager in 2000. When Denison Hydraulics Inc. was purchased by Parker Hannifin Corporation in 2003, he moved to a role in Parker’s global mobile group, where he remained until 2007, when he joined Eaton. Mr. Gotting is a graduate of Brighton College of Technology in England and holds higher education certificates in electronics and communications engineering.

Kennon Guglielmo serves as Co-General Manager of Enovation Controls, LLC (“Enovation”), which was acquired by the Company on December 5, 2016, and operates as a separate, standalone subsidiary. He co-founded Enovation in September 2009, first serving as its Chief Technology Officer and subsequently as its Co‑Chief Executive Officer, along with co-founder Frank Murphy, III. Dr. Guglielmo currently serves as CEO of Genisys Controls, LLC, a segment of Enovation that was carved out prior to Enovation’s acquisition by the Registrant. Dr. Guglielmo has been an independent director of Rush Enterprises, Inc. (NASDAQ:RUSHA) (NASDAQ:RUSHB) since January 2015. He holds a B.S. in Mechanical Engineering from Texas A&M University and an M.S. and Ph.D. in Mechanical Engineering from The Georgia Institute of Technology.

Jinger McPeak serves as Co-General Manager of Enovation Controls, LLC, which was acquired by the Company on December 5, 2016, and operates as a separate, standalone subsidiary. She joined the predecessor company to Enovation Controls in September 2004. In the 14 years with the company, Ms. McPeak has served in roles spanning from Market Management to Engineering, including leadership of the company-wide Display Solutions Team. Prior to the acquisition Ms. McPeak was the Vice President of Vehicle Technologies. She has over 20 years’ experience and has been responsible for all aspects of managing the critical success factors of Enovation Controls’ display and controller technology serving the recreational, marine and off-highway segments. Prior to joining the company, Ms. McPeak was employed at Mercury Marine, a Brunswick division, from May 1997 to September 2004 where she held several leadership positions, including Quality Engineer, Sales Administration Manager, Lean Six Sigma Program Officer and National Sales Manager. Her background includes a strong focus on market development and product portfolio strategy, including product quality & performance, program planning, timing and management, executive communication of strategic direction and tactical planning at all corporate levels. Ms. McPeak completed her education in 2001 by adding an MBA from Oklahoma State University to her Bachelor of Arts degree in Statistics. She currently serves on the BoatPAC board of the National Marine Manufacturers Association.

Craig Roser joined the Company in 2009 and had regional leadership responsibilities in marketing, sales and business development in the Americas before becoming Global Lead, CVT Sales and Business Development Lead in August of 2016. Mr. Roser graduated from the University of South Florida in 1979 with a mechanical engineering degree and worked in the

textile and tire making industries until 1983, when he joined Gulf Controls Company LLC, a Sun Hydraulics Distributor. Mr. Roser last served as Vice President Engineering of Gulf Controls before being selected in 2001 as President of Hydro Air LLC, another fluid power component and systems distributor who then had the same owner as Gulf Controls. He is a licensed professional engineer and participates in committee activities of the National Fluid Power Association and the American Society of Mechanical Engineers. Mr. Roser also earned a law degree from The Florida State College of Law and is a member of The Florida Bar.

Marc Bertoneche is an Emeritus Professor in Business Administration at the University of Bordeaux in France, and was on the Faculty of INSEAD, the European Institute of Business Administration in Fontainebleau, France, for more than 20 years. He was a Visiting Professor of Finance at the Harvard Business School. He is an Associate Fellow at the University of Oxford and a Distinguished Visiting Professor at HEC Paris. He is a graduate of University of Paris and earned his MBA and PhD from Northwestern University. He has served as a Director of the Company since August 2001. As an academic and a consultant to universities and businesses throughout the world, Dr. Bertoneche is exposed to diverse business leaders and brings a global perspective and depth of experience in the finance area.

Doug Britt has been a Director of the Company since December 2016. Mr. Britt is President of Flex Ltd. (NASDAQ: FLEX), a leading sketch-to-scale™ solutions company that provides innovative design, engineering, manufacturing, real-time supply chain insight, and logistics services to companies of all sizes in various industries and end-markets. From May 2009 to November 2012, Mr. Britt served as Corporate Vice President and Managing Director of Americas for Future Electronics, and from November 2007 to May 2009, he was Senior Vice President of Worldwide Sales, Marketing, and Operations for Silicon Graphics. From January 2000 to October 2007, Mr. Britt held positions of increasing responsibility at Solectron Corporation, culminating his career there as Executive Vice President, and was responsible for Solectron's customer business segments including sales, marketing and account and program management functions. Mr. Britt earned a bachelor’s degree in business administration from California State University, Chico, and attended executive education programs throughout Europe, including at the University of London. As an executive at multi-national companies, Mr. Britt has extensive global M&A experience and a deep understanding of customer relationships and leading a global business.

Allen Carlson joined the Company in March 1996 and served as Vice President from January 2000 until May 2000, when he was named President and Chief Executive Officer, serving in those roles until his retirement on March 31, 2016. He currently serves as director of the University of Florida’s Sarasota Innovation Station. From October 1977 to March 1996, Mr. Carlson held various engineering, marketing and management positions for Vickers Incorporated, a wholly-owned subsidiary of Trinova Corporation. He is a graduate of the Milwaukee School of Engineering and the Advanced Management Program at the Harvard Business School. Mr. Carlson is past chair and a member of the executive committee of the board of directors of the National Fluid Power Association, and he serves on the board of regents of the Milwaukee School of Engineering. He also is a director of Mayville Engineering Company, Inc. and KMCO, Inc. With over 40 years’ experience in the fluid power industry and 20 years with the Company, nearly 16 as President and Chief Executive Officer, Mr. Carlson has deep institutional knowledge and perspective regarding the Company’s strengths, challenges and opportunities.

Dave Grzelak has been a director of the Company since June 2015. He served as Chairman and Chief Executive Officer of Komatsu America Corporation from April 2002 until his retirement as Chief Executive Officer in April 2012 and as Chairman in July 2013. He then served as a consultant to Komatsu Ltd., Tokyo, Japan, until August 2015. With more than four decades of experience working in the industrial manufacturing sector and extensive experience in Asia, Mr. Grzelak brings a wealth of knowledge regarding the customers and markets in which the Company’s products are sold. Mr. Grzelak brings to the Board valuable insights on distribution, marketing and sales of the Company’s products as well as operational and financial expertise. Mr. Grzelak also serves as a director of Alamo Group Inc. (NYSE: ALG).

Chris Koski joined the executive team of nMetric, LLC as head of marketing in July 2006 and has served as its President and Chief Executive Officer since January 2011. Prior to joining nMetric, Ms. Koski founded Koski Consulting Group, Inc. in June 2001 to work with start-up companies in the area of business strategy and marketing. From 1980 through 2000, Ms. Koski held various positions in sales, product management, purchasing, sales management, and international marketing management with Celanese A.G. or its former affiliates, including Celanese Ltd., Hoechst AG and Hoechst Celanese Chemical Group Ltd. In June 2016 Ms. Koski purchased the probiotic business unit from Oragenics and is now the CEO of ProBiora Health LLC. Simultaneous to the acquisition, Ms. Koski resigned from the board of directors of Oragenics, Inc. (OGEN). Ms. Koski is also a member of the National Association of Corporate Directors, Dallas Chapter, and is an alumnus of Harvard’s Corporate Board Effectiveness Program led by Professor Jay Lorsch. Ms. Koski has served as a Director of the Company since May 2000. As the daughter of the Company’s founder, Ms. Koski has a unique understanding of the Company’s culture. Her international sales and marketing background contribute to the Board’s overall level of experience in these areas. Ms. Koski graduated from St. Lawrence University with a BS degree in chemistry and received an Executive MBA degree from Southern Methodist University.

Philippe Lemaitre retired in November 2006 as Chairman, President and Chief Executive Officer of Woodhead Industries, Inc., a publicly-held automation and electrical products manufacturer, upon its sale to Molex. Before joining Woodhead in 1999, Mr. Lemaitre was Corporate Vice President and Chief Technology Officer of AMP, Inc. and was also in charge of AMP Computer and Telecom Business Group Worldwide. Prior to joining AMP, Mr. Lemaitre was an Executive Vice President of TRW, Inc. and also General Manager of TRW Automotive Electronics Group Worldwide. He previously held various management and research engineering positions with TRW, Inc., International Technegroup, Inc., General Electric Company and Engineering Systems International. Mr. Lemaitre also served as Chairman of the Board of Directors of Multi-Fineline Electronix, Inc. from March 2011 until the sale of the company in July 2016. He holds a Master of Civil Engineering degree from Ecole Spéciale des Travaux Publics, Paris, France, and a Master of Science degree from the University of California at Berkeley, California. Mr. Lemaitre has served as a Director of the Company since June 2007, and as Chairman of the Board since June 2013. Mr. Lemaitre’s more than 32 years’ experience in the development of technology and technology-driven businesses, his track record of successfully managing global business functions including sales, engineering, research and manufacturing operations, and his role as Chairman of another public company provide a wealth of experience in key areas of the Company’s business and governance.

Alexander Schuetz serves as CEO of Knauf Engineering GmbH, an engineering company in the gypsum based construction materials industry. Prior to joining Knauf in February 2009, Dr. Schuetz held various management positions for more than 10 years in

Finance, Business Development, Mergers & Acquisitions, Project Management and General Management in the fluid power industry at Mannesmann and Bosch Rexroth, including as CEO of Rexroth Mexico and Central America from August 2000 to August 2007. From 1998 to 2000, he was based in Beijing, China and was responsible for the Finance, Tax and Legal division at Mannesmann (China) Ltd., the holding company for a number of affiliated companies of the Mannesmann Group, including Rexroth, Demag, Sachs and VDO. Dr. Schuetz holds a Ph.D. in international commercial law from the University of Muenster, Germany. In 2003, Dr. Schuetz completed the Robert Bosch North America International General Management Program at Carnegie Mellon University. Dr. Schuetz has served as a Director of the Company since June 2014. With more than 10 years working in the fluid power industry and extensive experience in major growth regions of the world, including Asia and Latin America, Dr. Schuetz brings global insights into markets and customers to Sun.

Board Leadership Structure and the Board’s Role in Risk Oversight The Board of Directors acts as a collaborative body that encourages broad participation of each of the Directors at Board meetings and in the committees, described below, on which they serve. The Board believes that a majority of Directors should be independent. Prior to each Board meeting the independent directors meet informally, and they also meet in regular executive sessions of the Board of Directors. The Company currently separates the functions of Chairman of the Board and Chief Executive Officer. The Chairman of the Board, who is anon-management, independent Directordirector chairs the meetings of the Board and also serves as a nonvotingex officio member of each of the Board committees. He setsapproves the agenda for each meeting, after soliciting suggestions from management and the other Directors. Given the size of the Company, its international operations and its culture of individual initiative and responsibility, the Board believes that its leadership structure is appropriate. The Board believes that a governing body comprised of a relatively small number of individuals with diverse backgrounds in terms of geographic, cultural and subject matter experience, strong leadership and collaborative skills, is best equipped to oversee the Company and its management. The Company’s culture emphasizes individual integrity, initiative and responsibility, and employs a horizontal leadershipresponsibility. The Company’s compensation structure in which there aredoes not rigid reporting requirements. Compensation is not based on financial or productivity metrics or on other objective criteria that would encourage individuals undertakingto undertake undue risk for personal financial gain. The Board has delegated to the Audit Committee the responsibility for financial risk and fraud oversight, to consider for approval all transactions involving conflicts of interest and to monitor compliance with the Company’s Code of Ethics. Business Conduct and Ethics (“Code”). The Governance and Nominating Committee addressesnon-financial risks, including political and economic risks, risks relating to the Company’s growth strategy, and current business risks on a quarterly basis, and makes recommendations to the Board has determined that a separate risk oversight committee is not necessarywith respect to monitorthose and other risks. Instead,risks, including leadership development and succession. To supplement the reports of the Governance and Nominating Committee, the Chief Executive Officer reports to the full Board, at least annually, regarding material risks facing the Company, risks it may face in the future, measures that management has employed to address those risks and other information regarding how risk analysis is incorporated into the Company’s corporate strategy andday-to-day business operations. The Governance As part of its risk oversight and Nominating Committee also addresses non-financial risks, including development and succession of leadership, and makes recommendations tocompliance responsibilities, the Board with respectof Directors, in December 2018, adopted a new Code that serves as an overarching document to thosesupplement similar policies adopted by its subsidiaries. The Code has been | | |  | | 2019 Proxy Statement| 7 |

| | Governance of the Company |

translated into five languages, and other risks facingtraining programs are held to ensure the code is understood and observed throughout the Company. In July 2018, the Board appointed a Chief Legal and Compliance Officer (“CLCO”) who oversees and manages the legal and compliance functions of the Company on a global basis. Independence and Committees of the Board of Directors Independence of Directors. At its meeting in March 2018,8, 2019, the Board undertook a review of Director independence.Independence. It determined that there were no transactions or relationships between any of the Directors or any member of the Director’s immediate family and the Company and its

subsidiaries and affiliates. The purpose of this review was to determine the independence of each of the Directors under the rules of the Nasdaq Stock Market and, for audit committee members, also under the rules of the Securities and Exchange Commission. The Board determined that, other than the current and the recently-retired CEO, all of the Company’s Directors:Directors, Messrs. Bertoneche, Britt, Grzelak, Lemaitre, Schuetz and Wormley,Schuetz, and Ms. Koski, (except with respect to the audit committee) qualify as independent. The Board of Directors has the three standing committees listed below. Audit Committee.Committee The Audit Committee, comprised of Marc Bertoneche, Doug Britt, David W. Grzelak (Chair), and Alexander Schuetz, held 10nine meetings in 2017.2018. The Board of Directors determined, under applicable SEC and NASDAQ rules, that all of the members of the Audit Committee are independent and that Dr. Bertoneche meets the qualifications as an Audit Committee Financial Expert, and he has been so designated. The functions of the Audit Committee are to select the independent public accountants who will prepare and issue an audit report on the annual financial statements of the Company and a report on the Company’s internal controls over financial reporting, to establish the scope of and the fees for the prospective annual audit with the independent public accountants, to review the results thereof with the independent public accountants, to review and approvenon-audit services of the independent public accountants, to review compliance with existing major accounting and financial policies of the Company, to review the adequacy of the financial organization of the Company, to review management’s procedures and policies relative to the adequacy of the Company’s internal accounting controls, to review areas of financial risk and provide fraud oversight, to review compliance with federal and state laws relating to accounting practices and to review and approve transactions, if any, with affiliated parties. It also invites and investigates reports regarding accounting, internal accounting controls or auditing irregularities or other matters. The Audit Committee is responsible for review of management’s monitoring of the Company’s compliance with its Code, of Ethicsincluding its confidential ethics reporting hotline and the periodic review and update of the code. No waivers of the Company’s Code of Ethics were requested or granted during the year ended December 31, 2017.29, 2018. The Code of Ethics is available on the Investor RelationsInvestors page of our Web sitewww.sunhydraulics.comwww.heliostechnologies.com and from the Company upon written request sent to Corporate Secretary, 1500 West University Parkway, Sarasota, Florida 34243. The Audit Committee is governed by a written charter approved by the Board of Directors. The charter is available on the Investor RelationsInvestors page of our Web sitewww.sunhydraulics.com www.heliostechnologies.comand from the Company upon written request sent to the Corporate Secretary, 1500 West University Parkway, Sarasota, Florida 34243. Compensation Committee.Committee The Compensation Committee, comprised of Marc Bertoneche, Douglas M. Britt (Chair), and Christine L. Koski, oversees the Company’s compensation program, including executive compensation and the review, approval and recommendation to the Board of Directors of the terms and conditions of all employee benefit plans or changes thereto. The Committee administers the Company’s restricted stockequity incentive and stock optionnon-employee director fees plans and carries out the responsibilities required by the rules of the Securities and Exchange Commission. The Committee met fivesix times during 2017.2018.

The Compensation Committee is governed by a written charter approved by the Board of Directors. The charter is available on the Investor RelationsInvestors page of our Web sitewww.sunhydraulics.com www.heliostechnologies.comand from the Company upon written request sent to the Corporate Secretary, 1500 West University Parkway, Sarasota, Florida 34243. Governance and Nominating Committee.Committee The Governance and Nominating Committee, comprised of David W. Grzelak, Christine L. Koski, and Alexander Schuetz (Chair), held four meetings in 2017.2018. The primary purpose of the Committee is to identify and recommend to the Board individuals qualified to become members of the Board of Directors, consistent with criteria approved by the Board, develop | | | 8 |2019 Proxy Statement | |  |

| | Governance of the Company |

and recommend to the Board corporate governance guidelines and policies for the Company, and monitor the Company’s compliance with good corporate governance standards. The Committee also addressesnon-financial risks, including development and succession of leadership, and makes recommendations to the Board with respect to those and other risks facing the Company. The Governance and Nominating Committee is governed by a written charter approved by the Board of Directors. The charter is available on the Investor RelationsInvestors page of our Web site www.sunhydraulics.com websitewww.heliostechnologies.comand from the Company upon written request sent to the Corporate Secretary, 1500 West University Parkway, Sarasota, Florida 34243. The Board has adopted a Statement of Policy Regarding Director Nominations, setting forth qualifications of Directors, procedures for identification and evaluation of candidates for nomination, and procedures for recommendation of candidates by shareholders. As set forth in the Statement of Policy, a candidate for Director should meet the following criteria: must, above all, be of proven integrity with a record of substantial achievement;

| • | | must, above all, be of proven integrity with a record of substantial achievement; | |

must have demonstrated ability and sound judgment that usually will be based on broad experience;

| • | | must have demonstrated ability and sound judgment that usually will be based on broad experience; | |

must be able and willing to devote the required amount of time to the Company’s affairs, including attendance at Board and committee meetings and the annual shareholders’ meeting;

| • | | must be able and willing to devote the required amount of time to the Company’s affairs, including attendance at Board and committee meetings and the annual shareholders’ meeting; | |

must possess a judicious and somewhat critical temperament that will enable objective appraisal of management’s plans and programs; and

| • | | must possess a judicious and somewhat critical temperament that will enable objective appraisal of management’s plans and programs; and | |

must be committed to building sound, long-term Company growth.

| • | | must be committed to building sound, long-term Company growth. | |

Other than the foregoing, the Board does not believe there is any single set of qualities or skills that an individual must possess to be an effective Director or that it is appropriate to establish any specific, minimum qualifications for a candidate for election as a Director. Rather, the Committee will consider each candidate in light of the strengths of the other members of the Board of Directors and the needs of the Board and the Company at the time of the election. The Company does not have a formal policy with regardAs discussed below under “Oversight of Environmental, Social and Governance (ESG) Matters,” the Board of Directors formally memorialized the Company’s commitment to fundamental ethical principles, including diversity and respect for the considerationdignity of diversity in identifying Director nominees, but theevery individual. The Governance and Nominating Committee striveswill continue to nominate Directors with diverse backgrounds in terms of geographic, cultural and subject matter experience that are complementary to those of the other Directors so that, as a group, the Board will possess the appropriate talent, skills and expertise to oversee the Company’s business.

The Committee will take whatever actions it deems necessary under the circumstances to identify qualified candidates for nomination for election as a member of the Board of Directors, including the use of professional search firms, recommendations from Directors, members of senior management and security holders. All such candidates for any particular seat on the Board shall be evaluated based upon the same criteria, including those set forth above and such other criteria as the Committee deems suitable under the circumstances existing at the time of the election. Shareholder recommendationsRecommendations for Nomination as a Director.In order for the Committee to consider a candidate recommended by a shareholder, the shareholder must provide to the Corporate Secretary, at least 120, but not more than 150, days prior to the date of the shareholders’ meeting at which the election of Directors is to occur, a written notice of suchsuch security holder’s desire that such person be nominated for election at the upcoming shareholders meeting; provided, however, that in the event that less than 120 days’ notice or prior public disclosure of the date of the meeting is given or made to shareholders, notice by the shareholder to be timely must be received not later than the close of business on the tenth business day following the day on which such notice of the date of the meeting was mailed or such public disclosure was made, whichever first occurs. | | |  | | 2019 Proxy Statement| 9 |

| | Governance of the Company |

A shareholder’s notice of recommendation must set forth: | (a) | as to each person whom the shareholder proposes be considered for nomination for election as a Director, |

| (i) | the name, age, business address and residence address,address; |

| (ii) | his or her principal occupation or employment during the past five years, |

| (iii) | the number of shares of Company common stock he or she beneficially owns, |

| (iv) | any other information relating to the person that is required to be disclosed in solicitations for proxies for election of Directors pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended, and | |

| (v) | the consent of the person to serve as a Director, if so elected; and |

(b)as to the shareholder giving the notice

| (b) | as to the shareholder giving the notice |

| (i) | the name and record address of shareholder, |

| (ii) | the number of shares of Company common stock beneficially owned by the shareholder, |

| (iii) | a description of all arrangements or understandings between the shareholder and each proposed nominee and any other person pursuant to which the nominations are to be made, and | |

| (iv) | a representation that the shareholder intends to appear in person or by proxy at the meeting to nominate the person(s) named. | |

Director Participation and Relationships The Board of Directors held sixnine meetings during 2017, with2018, and all of the Directors were present at each meeting. Each Director also attended all of the meetings of each committee of which he or she was a member in 2017, except that two Directors missed one meeting each.2018. The Board of Directors has adopted a policy stating that it is in the best interests of the Company that all Directors and nominees for Director attend each annual meeting of the

shareholders of the Company. The policy provides that the Board, in selecting a date for the annual shareholders meeting, will use its best efforts to schedule the meeting at a time and place that will allow all Directors and nominees for election as Directors at such meeting to attend the meeting. The policy further provides that an unexcused absence under the policy should be considered by the Governance and Nominating Committee in determining whether to nominate a Director forre-election at the end of his or her term of office. All of the Directors attended last year’s annual meeting of shareholders. No family relationships exist between any of the Company’s Directors and executive officers. There are no arrangements or understandings between Directors and any other person concerning service as a Director. Compensation Committee Interlocks and Insider Participation None. Section 16(a) Beneficial Ownership Reporting Compliance Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s Directors, officers and holders of more than 10% of the Company’s Common Stock to file with the Securities and Exchange Commission initial reports of ownership and reports of changes in ownership of Common Stock and any other equity securities of the Company. To the Company’s knowledge, based solely upon a review of the forms, reports and certificates filed with the Company by such persons, all of them complied with the Section 16(a) filing requirements in 2017.2018, except for Christine L. Koski and Tricia L. Fulton who each filed one Form 4, reporting one transaction late. Communications with the Board of Directors Shareholders and other parties interested in communicating with our Board of Directors may do so by writing to the Board of Directors, Sun Hydraulics Corporation d/b/a Helios Technologies, 1500 West University Parkway, Sarasota, Florida 34243. Under the process for such communications established by the Board of Directors, the Chairman of the Board reviews all such correspondence and regularly forwards it, or a summary of the correspondence, to all of the other members of the | | | 10 |2019 Proxy Statement | |  |

| | Governance of the Company |

Board. Directors may at any time review a log of all correspondence received by the Company that is addressed to the Board or any member of the Board and request copies of any such correspondence. Additionally, correspondence that, in the opinion of the Chairman, relates to concerns or complaints regarding accounting, internal accounting controls and auditing matters is forwarded to the Chair of the Audit Committee. Environmental, Social and Governance (ESG) Matters Corporate responsibility and sustainability are reflected in the Company’s business strategy. The Board of Directors recently reviewed the Company’s historical commitment to principles of corporate and social responsibility. The Company is committed to reducing emissions, recycling, and minimizing its environmental footprint and has implemented several strategies to achieve these goals. The Company is also fully committed to the safety of its employees and the safety of those who use its products. Additionally, the Company actively seeks to support diversity initiatives in its hiring and employment practices. The Board and its committees will continue to assist the Company in its oversight of corporate social responsibilities, significant public policy issues, health and safety, and climate-change related trends. Below is a summary of the Company’s ESG activities for 2018.

| Governance/Business Conduct |

We are committed to conducting our business with ethics and integrity. This expectation is memorialized in the policies and procedures applicable to our employees, vendors, and partners across the globe. All of our operating companies maintain their own individual ethics and code of conduct policies, the collective policies of which are also incorporated into our corporate policy, the Code. In addition, the Helios companies maintain ethical and conduct standards for their suppliers across the globe. Helios maintains a confidential ethics and reporting hotline that can be accessed by employees all over the globe (heliostechnologies.ethicspoint.com). Both the Audit and Governance Committees of the Board of Directors oversee the ethics and compliance programs of the Company. As noted above, in 2018 Helios hired a Chief Legal and Compliance Officer, who oversees our ethics and compliance programs and provides advice and counsel on a regular basis to Helios and its employees on these topics.

| Environment |

Across the globe, Helios companies are committed to leading in their industries to minimize the impact of their activities on the environment. The Company is committed to reducing emissions, recycling, and minimizing its environmental footprint. The key points of Helios’s strategy to achieve these goals are: | • | | Minimize waste by evaluating operations and ensuring they are as efficient as possible; | |

| • | | Minimize toxic emissions through efficient use of water and energy; | |

| • | | Raise environmental awareness, encourage participation, and train employees; | |

| • | | Actively promote recycling both internally and amongst our customers and suppliers; | |

| • | | Source and promote products to minimize the environmental impact of both production and distribution; | |

| • | | Meet or exceed all the local environmental legislation relative to the Company in all countries where we are present; | |

| • | | Use of biodegradable or alternatives to chemicals while minimizing use of solvents; and | |

| • | | Continuously seek to improve our environmental performance. | |

| | |  | | 2019 Proxy Statement| 11 |

| | Governance of the Company |

In line with these efforts, below are some examples of our 2018 achievements: | • | | Ninety percent (90%) of waste generated from our Enovation facility in Oklahoma goes to awaste-to energy facility. Our facilities also recycle paper, cardboard, electronic waste, and scrap metal; | |

| • | | At Sun Hydraulics, we converted our Series 1 valves into single piece plastic clamshell packaging that is made from recycled PET and plan to covert more products to this packaging; | |

| • | | At Enovation, we have a lighting efficiency improvement project. Our Oklahoma facilities have been converted to full LED and motion sensing lighting. Meanwhile, our manufacturing building warehouse is being converted to LED in the high bay areas; | |

| • | | At Custom Fluidpower Pty Ltd (“CFP”), the company uses recycled grey water for toilet facilities, has replaced all lighting with energy efficient LED lights, and has recycling programs for cardboard, paper and steel. The Company also installed 160 solar panels on its roof in Mackay, providing 45% of the daytime power use; and | |

| • | | Our Sun Hydraulics plants in Sarasota utilize a thermal energy storage system to reduce its energy consumption. The system uses chillers to create ice during off peak hours that is burned off during peak hours to cool our facilities. This system reduced our electrical usage by approximately fifty percent (50%). | |

| Social |

The Company and its employees have a long history of caring for our communities around the world and the people we employ. The Company supports social welfare programs around the globe through financial efforts and employee engagement. The Company is fully committed to the safety of its employees and the safety of those who use our products. Additionally, the Company actively seeks to support diversity initiatives in its hiring and employment practices. Below are some highlights of some of these efforts made by our companies in 2018. 1.Diversity & Inclusion The Company believes that diversity and inclusion is critical for the attraction and retention of top talent. We are investing in global leadership programs that support and develop our talent throughout the world. Of particular note, 43% of our executive officers are female. In our corporate headquarters, 54% of the professionals are female. In addition, our Enovation workforce is comprised of 44% minorities and 41% female. As a contributor to our proactive efforts to attract a diverse workforce, Enovation participates in a number of diversity events, including the Oklahoma State University’s Women’s Business Leadership Conference. | | | 12 |2019 Proxy Statement | |  |

| | Governance of the Company |

2.Community Below are some highlights from 2018 demonstrating the Helios companies’ commitment to the communities in which we operate: | • | | Sun Hydraulics employees donated nearly 300 hours to Habitat for Humanity; | |

| • | | Sun Hydraulics donated $235,000 to a variety of charities, focusing on 501(c)(3) organizations where employees have an active role in volunteering; | |

| • | | Faster donated $21,000 to Red Cross Hurricane Relief and $5,000 to St. Ursula Academy STEM Robotics; | |

| • | | Enovation employees are actively involved in supporting the Community Food Bank of Eastern Oklahoma, the Muscular Dystrophy Association, American Cancer Society, and local veterans’ organizations; | |

| • | | CFP sponsors a four-year scholarship program with the University of Newcastle for a Mechatronics Engineering student valued at $40,000 AUD; | |

| • | | CFP’s President volunteers his time as a member of the Honorary Advisory Board for the Engineering Faculty at the University of Newcastle and of the Advisory Council for the Australian Industry Group regarding Manufacturing, Industrial Relations and Safety for employers; | |

| • | | At CFP, our National Mechatronics Engineer partners with the University of Newcastle in a mechatronics advisory capacity; | |

| • | | CFP sponsors a sporting facility for the small community of Sarina for $15,000 AUD per annum; | |

| • | | Faster supports a program entitled “Faster Academy”, which is a training program for people unemployed. As a result of this program, the participants are prepared to be hired at Faster or by other companies within our industry; and | |

| • | | Faster supports its local community by participating in the program “Fare Legami” (Create Links) and its employees regularly attend various social initiatives related to this. | |

| | |  | | 2019 Proxy Statement| 13 |

| | Governance of the Company |

3.Safety & Health The Company is committed to the safety of its customers and its employees. Each company within our group maintains environmental, health and safety policies that seek to promote the operation of our business in a manner that is protective of the health and safety of the public and our employees. Several of our businesses have onsite medical clinics for employees and their families. Our companies offer several health and welfare programs to employees to promote fitness and wellness and preventative healthcare. In addition, our employees are offered a confidential employee assistance program that provides professional counselling to employees and their family members. Some other examples of our safety and health initiatives are below: | • | | Enovation is a member of the Oklahoma Safety Council and the National Safety Council; | |

| • | | Employees are trained to be First Responders, given the opportunity to receive OSHA 30 certifications, and our locations have a Certified First Aid/CPR/AED Trainer on site; | |

| • | | Enovation has a Safety Near Miss Program to encourage employee awareness and involvement in identifying safety risks; | |

| • | | Our Faster subsidiary has been recognized in the top 3 companies in Italy across our sector as a “best workplace” from a national magazine (called Panorama) underscoring our achievements in the areas of Welfare, Academy and Training; | |

| • | | Faster has developed a relocation program to encourage employment in areas of Italy with a high unemployment rate; | |

| • | | Faster, in conjunction with its union, has developed other programs dedicated to work-life balance, save-time services, harassment prevention, and other welfare benefits; | |

| • | | At Sun Hydraulics, a learning management system was implemented by Human Resource and Safety Management for more efficient employee training and compliance tracking capabilities. Training is managed and scheduled online and made available to employees through any digital device.In-house production of training videos and materials allow custom content for improved results; | |

| • | | Working with Sun Hydraulics IT developers, the Human Resource and Safety Managers created an online incident reporting tool to process all safety incidents, incident investigations, and associated action items; and | |

| • | | Sun Hydraulics provides proactive health services including massage and physical therapy. Our Industrial Athletic Trainer was named 2018 Trainer of the Year and provides ergonomic exercise training for employees, early treatment of injuries, and work routine recommendations. | |

| | | 14 |2019 Proxy Statement | |  |

AUDIT COMMITTEE REPORT The following report shall not be deemed to be incorporated by reference into any filings made by the Company under the Securities Act of 1933 or the Securities Exchange Act of 1934,, except to the extent that the Company specifically incorporates it by reference, or to be “soliciting“soliciting material” or to be “filed” with the Securities and Exchange Commission or subject to Regulations 14A or 14C or to the liabilities of Section 18 of the Securities Exchange Act of 1934. Management is responsible for the Company’s internal controls, financial reporting process, compliance with laws and regulations and ethical business standards. The independent accountants are responsible for performing an independent audit of the Company’s consolidated financial statements and internal controls over financial reporting based on criteria established in